Before we dive into the registration process, let’s discuss VAT and its procedures.

What is VAT according to UAE Law?

In the UAE, Value Added Tax (VAT) is an indirect tax introduced on January 1, 2018. It is applied at a standard rate of 5% on most goods and services. Here are some key points about VAT in the UAE:

- Scope: VAT is levied on the majority of goods and services, with certain exemptions and zero-rated supplies.

- Collection: Businesses act as tax collectors on behalf of the government, charging VAT on their sales and reclaiming VAT on their purchases.

- Administration: The Federal Tax Authority (FTA) oversees the implementation, collection, and enforcement of VAT.

- Purpose: VAT helps diversify the UAE’s revenue sources, reducing reliance on oil revenues and supporting public services and infrastructure.

How does the UAE’s government benefit from VAT?

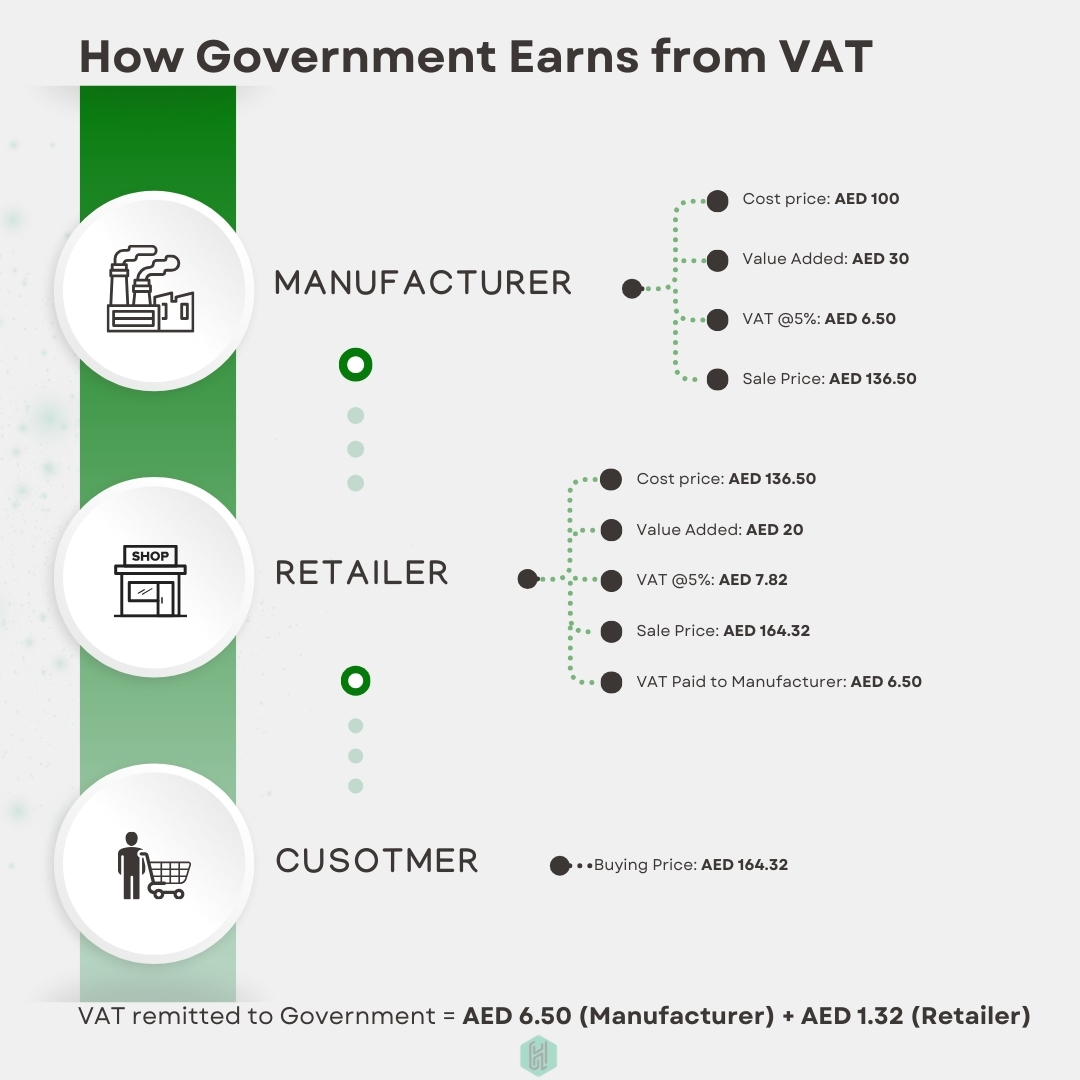

Understanding how the government benefits from Value Added Tax (VAT) is crucial for both businesses and consumers. VAT is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. This tax system not only generates significant revenue for the government but also promotes transparency and compliance within the economy.

The following image shows how VAT is applied at different stages of the supply chain and how it contributes to government revenue:

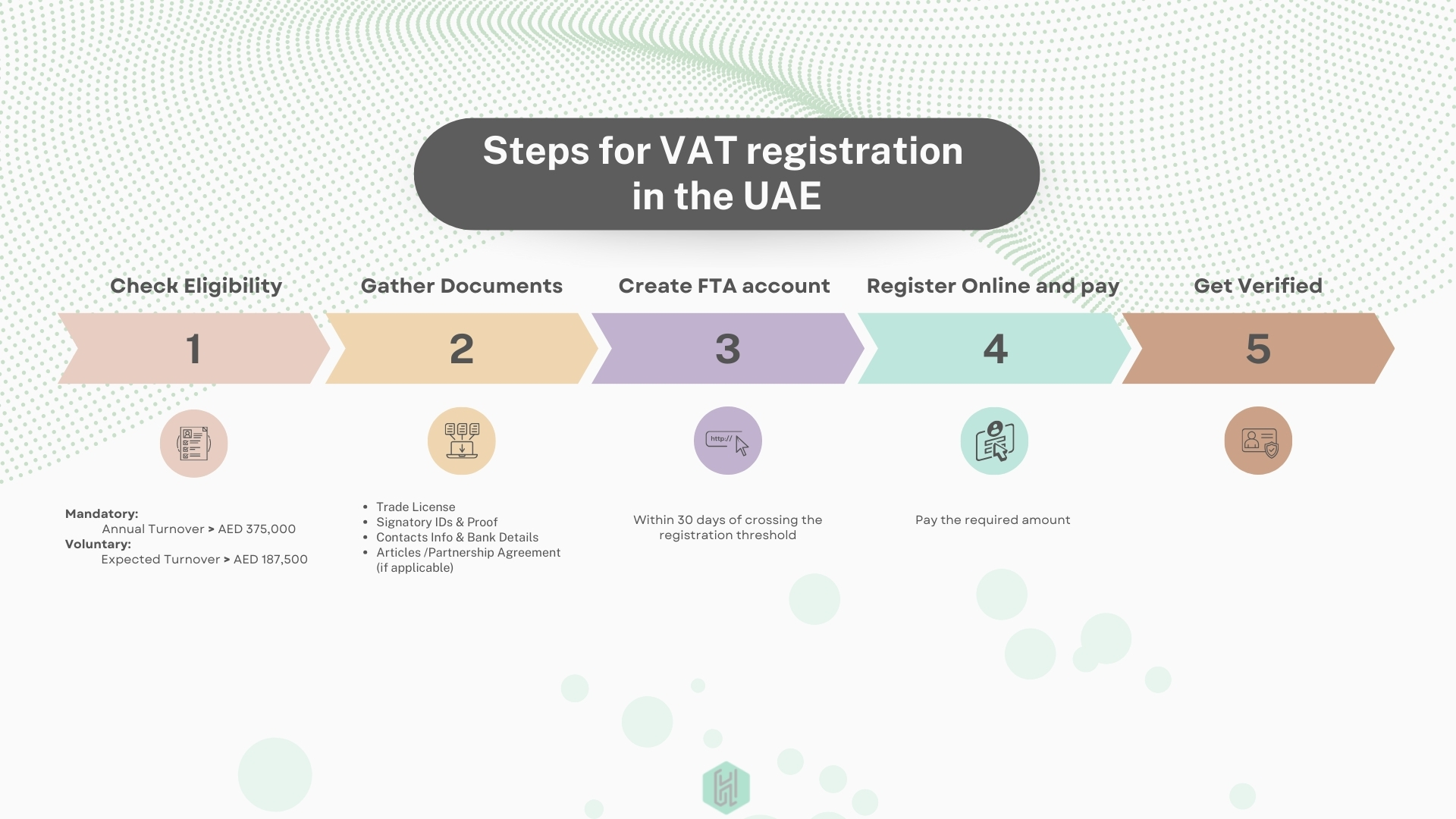

Step-by-Step Guide to Register for VAT in the UAE

Registering for VAT is important for businesses to follow the law and avoid fines.

Carefully follow these steps to complete your registration.

1. Determine Eligibility

First, check if your business needs to register for VAT.

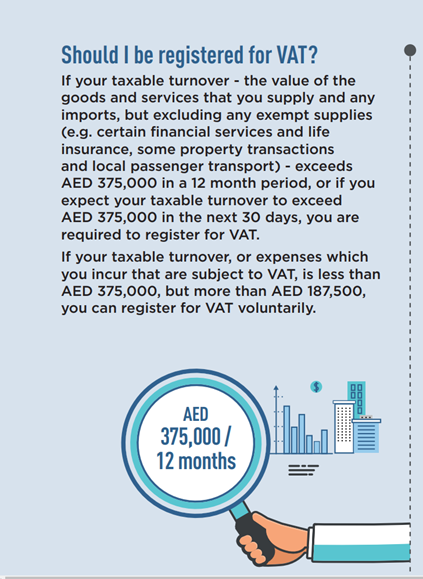

Eligibility: If your business sold goods worth AED 400,000 last year, you must register for VAT. If you sold goods worth AED 200,000, you can choose to register.

There are two types of VAT registration:

- Mandatory Registration: If your business made more than AED 375,000 in the past 12 months or expects to make more than this amount in the next 30 days, then it is mandatory for you to register your business to avoid penalties.

Note: Imagine you run a retail store, and your annual sales exceed AED 375,000. If you fail to register for VAT, you could be fined AED 20,000 and face additional penalties for not submitting VAT returns. This could lead to legal action and damage your business’s reputation.

- Voluntary Registration: If your business made more than AED 187,500, you can choose to register even if it’s not required.

2. Create an e-Services Account

To register for VAT, you need an account on the Federal Tax Authority (FTA) website:

- Go to the E-services FTA website.

- Click on ‘Sign up’ and fill in your details to create an account.

Example: Enter your email, create a password, and provide your contact information.

3. Complete the VAT Registration Form

Once your account is ready, log in and follow these steps:

- Go to the VAT registration section.

- Fill out the form with your business details, such as:

- Business name and address

- Contact details

- Bank account information

- Business activities (what your business does)

- Turnover details (how much money your business makes)

- Import and export activities (if you buy or sell goods outside the UAE)

Example: If your business is a bakery, you would list “bakery” as your business activity and provide details about your sales and purchases.

4. Submit Required Documents

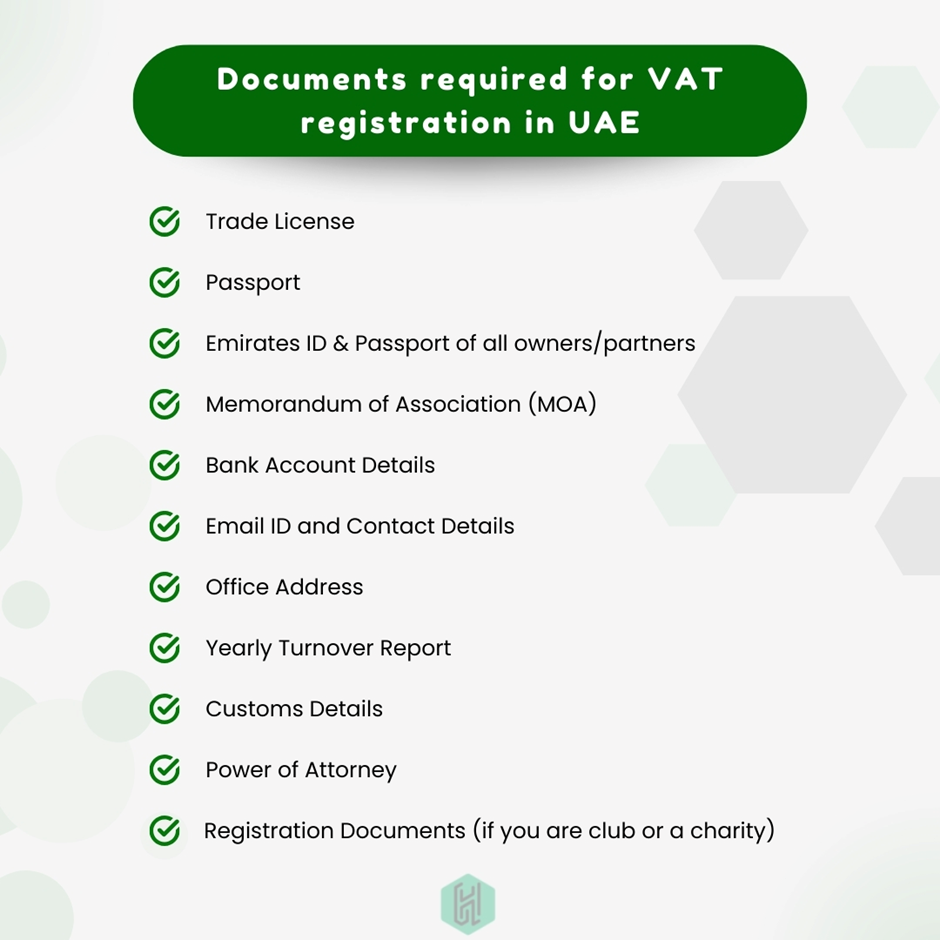

You will need to upload some documents to support your application:

- Trade License: Your business’s official license.

- Memorandum of Association (MOA): A document that outlines your business’s structure and purpose.

- Bank Account Details: Information about your business bank account.

- Office Address Proof: Evidence of your business’s physical address, like a utility bill or lease agreement.

- Contact Information: Your email and phone number for communication with the Federal Tax Authority (FTA).

- Yearly Turnover Report: A report showing your business’s annual income.

- Customs Registration Number: If your business deals with imports and exports, provide this number.

- Emirates ID & Passport: Copies of the Emirates ID & Passport for all partners or managers involved in the business.

- Proof of Customs Duties Paid: If applicable, documents showing customs duties paid on imports and exports.

- Other Documents: Any additional documents requested by the FTA.

Example: If you own a bakery, you would upload your trade license, your passport copy, your Emirates ID, and a copy of your lease agreement for the bakery location.

5. Receive Tax Registration Number (TRN)

After your application is approved, you will get a Tax Registration Number (TRN) by email.

Note: Once you receive your TRN, you should include it on all your sales invoices and receipts.

Exempt from VAT by UAE Law

As per the the UAE Federal Decree-Law No. (8) of 2017, The following items are exempt from VAT.”

- Financial Services: This includes life insurance and reinsurance of life insurance, as well as financial services that are not conducted for an explicit fee, discount, commission, rebate, or similar type of consideration.

- Residential Buildings: Supplies of residential buildings, except those that are specifically zero-rated, are exempt.

- Bare Land: The supply of undeveloped land is exempt from VAT.

- Local Passenger Transport: This includes services like public transportation within the UAE.

In the UAE, certain goods and services are exempt from VAT. Here are some key categories of VAT-exempt supplies:

Additional Tips

- Checklist of Documents: Keep a list of all required documents to make the registration process easier.

- Maintain Proper Records: Keep accurate records and bookkeeping to stay compliant with VAT regulations.

Additional Information

VAT Group Registration

If you have multiple businesses, you can register them as a VAT group. This allows you to file a single VAT return for all the businesses in the group. To do this, you need to meet certain conditions, such as having common control over the businesses.

Example: If you own a bakery and a café, you can register both under a single VAT group if the same person or entity controls them.

Penalties for Late Registration

It’s important to register for VAT on time to avoid penalties. The FTA imposes fines for late registration, which can be significant.

Example: If you delay your registration and miss the deadline, you could face a fine of AED 20,000.

VAT Compliance

After registering, you must comply with VAT regulations, including:

- Issuing VAT invoices

- Filing regular VAT returns

- Keeping detailed records of all transactions